Early PMI survey data for April indicate that the UK economy’s

recovery from recession last year continued to gain momentum.

Improved growth in the service sector offset a renewed downturn in

manufacturing to propel overall business growth to the fastest for

nearly a year, indicating that GDP is rising at a quarterly rate of

0.4% after a 0.3% gain in the first quarter.

The upturn encouraged firms to take on workers in increased

numbers which, alongside April’s rise in the National Living Wage,

drove cost pressures sharply higher. Although selling price

inflation cooled slightly, the upturn in costs alongside solid

demand suggests firms may seek to raise prices in the coming

months.

While the improving economic recovery picture is welcome news,

the upward pressure on inflation will add to concerns that a

sustainable path to below target inflation has not yet been

achieved.

Economic growth at 11-month high

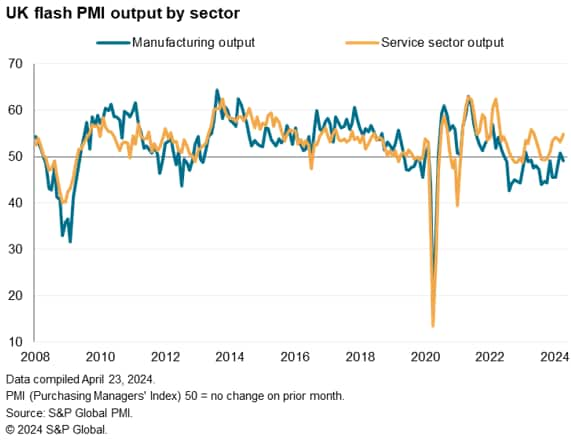

Business activity growth accelerated to an 11-month high in

April, according to early PMI survey indications. The headline

economic growth indicator from the flash PMI surveys, the

seasonally adjusted S&P Global UK Composite Output Index,

registered 54.0 in April against 52.8 in March. The latest reading

signals a sixth successive monthly expansion of output, with the

rate of growth rising to the highest since May of last year.

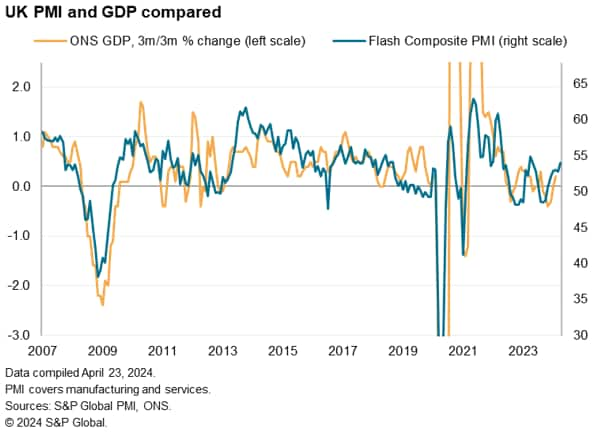

April’s expansion is broadly consistent with GDP growing at a

quarterly rate of almost 0.4% at the start of the second quarter,

building further on the robust 0.25% gain signalled by the PMI in

the first quarter.

The survey data therefore indicate that the UK economy continues

to pull out of the technical recession seen late last year,

recovering to register solid growth.

The latest official GDP are also showing signs of the recession

having ended, with monthly GDP having risen for a second successive

month in February. First quarter GDP data are so far also running

0.3% above the fourth quarter of last year, in line with the PMI

signal.

Services-driven growth while manufacturing

stabilises

April’s improvement was driven by the service sector, which as a

whole grew at the strongest rate seen for 11 months. Trends varied

markedly within services, however. The strongest performing sector

was financial services, followed by tech/IT, but only a modest gain

was recorded for business services, and other sectors such as

transport and hospitality reported falling output.

Falling output was also seen in the manufacturing sector,

reversing the modest return to growth in March (which had seen the

first increase in factory output for just over a year).

Elevated optimism – in the service sector

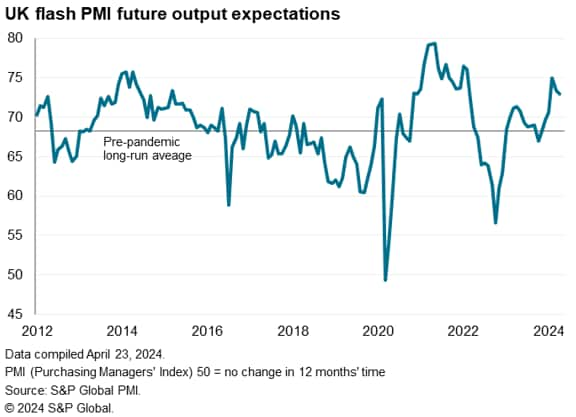

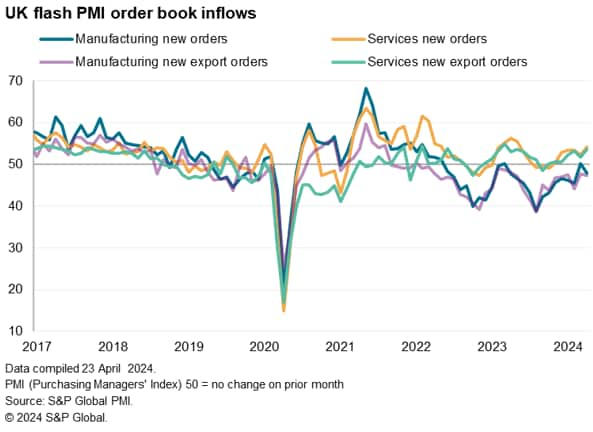

The improved business growth in April was accompanied by

continued elevated levels of optimism about the 12-month outlook.

Business expectations about the year ahead fell further from

February’s two-year high but remained well above the survey’s

long-run average, in part reflecting an accelerated rate of

increase of new orders, which rose at the sharpest pace for 11

months.

However, sector variations were again evident by sector in terms

of outlooks and order books. Manufacturing future sentiment fell to

a four-month low as new orders contracted after a marginal gain in

March, linked largely to lower exports, which have now fallen

continually for 27 months. In contrast, service sector future

sentiment lifted higher, amid increased rates of growth of both new

business and exports.

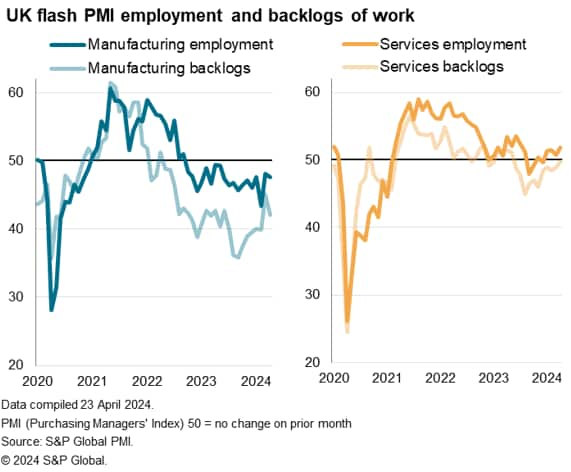

Hiring picks up

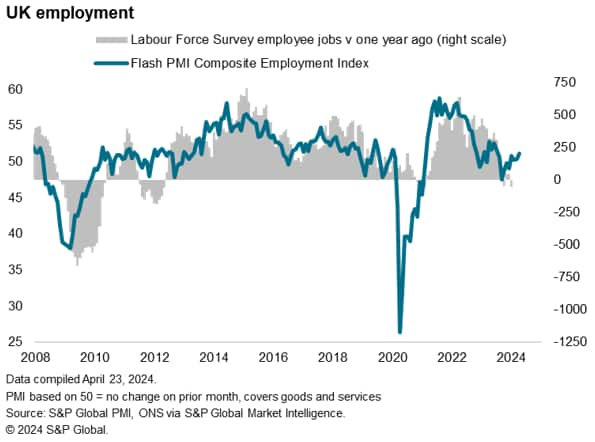

Hiring picked up on the back of the improved demand situation

and increased workloads, albeit with gains limited to the service

sector. Measured overall, employment rose for a fourth successive

month in April, rising at the fastest rate for nine months.

However, a steeper rate of jobs growth in the service sector was

countered by a slight acceleration in the rate of factory job

culling. While service sector payrolls have now risen for four

successive months, manufacturing headcounts have fallen continually

over the past 19 months.

Selling price inflation cools despite National Living

Wage adding to price pressures

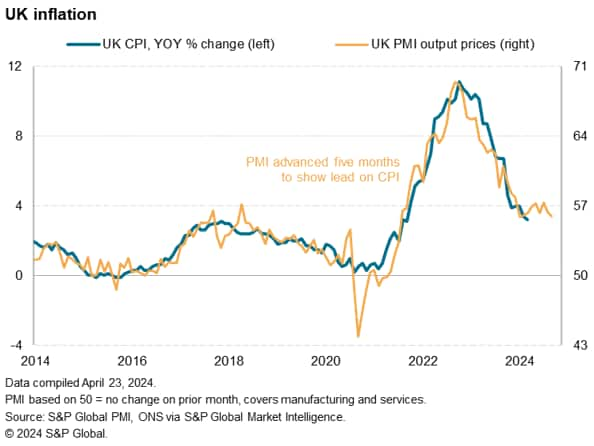

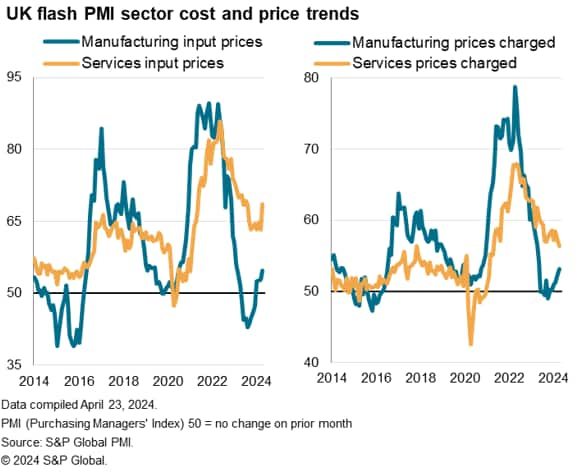

Average selling prices charged for goods and services rose in

April at the slowest rate since last August, and the joint-slowest

rate since February 2021. The latest data nevertheless remain

elevated by historical standards, and broadly consistent with

inflation (headline CPI) running close to 4%. There were also some

notable details beneath the headline selling price number, which

hint at some possible renewed near-term upward pressure on

prices.

Encouragingly, service sector selling price inflation, which has

proven to be the most stubborn aspect of inflation in recent

months, slowed in April to a three-year low. However, service

sector input cost inflation jumped higher to hit a nine-month high,

buoyed in particular by higher wages.

It should be noted that the April PMI data include the impact of

the introduction of the latest

National Living Wage (NLW) increase. Effective from 1st April,

the recommended wage increased from £10.42 to £11.44, a rise of

9.8%.

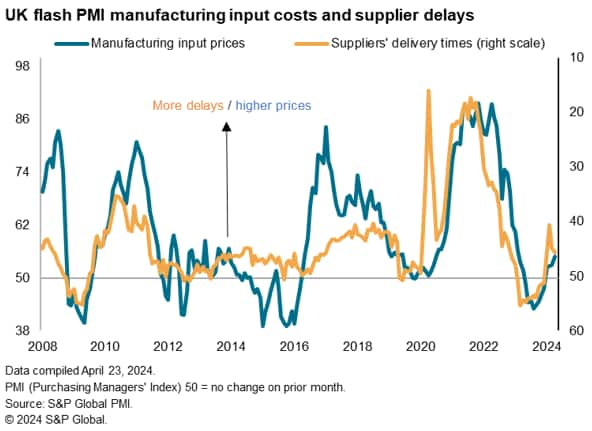

Manufacturers’ selling prices meanwhile rose at the sharpest

pace since last May, as firms passed higher costs on to customers.

Manufacturing costs grew at the fastest rate since February 2023,

having now risen for four consecutive months after eight months of

continual decline.

In manufacturing, an additional cost driver was renewed raw

material supply shortages. April saw average supplier delivery

times lengthen for a fourth successive month, with delays again

often linked to Red Sea-related shipping disruptions. Longer

lead-times tend to be associated with higher prices as a reflection

of demand exceeding near-term supply, though the need to re-route

ships around Africa has also directly raised shipping costs so far

this year.

Average input costs across goods and services consequently rose

sharply in April, the rate of inflation surging to the highest

recorded since last May. The 4.8 point increase in the Composite

Input Cost index was the largest recorded since October 2021, and

represents a hike in costs that companies may seek to pass on to

some degree to customers in the coming weeks or months.

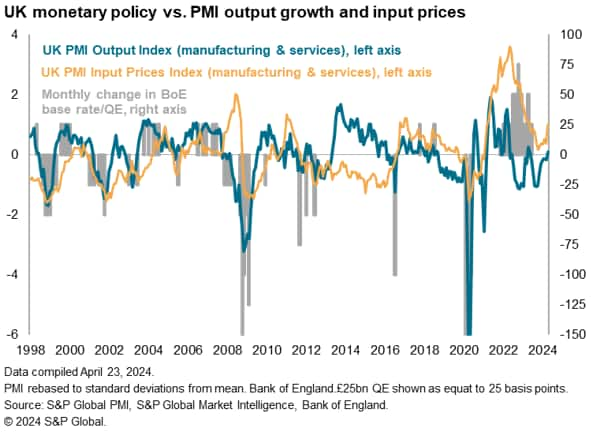

Not a rate cutting environment

The latest PMI data follow growing expectations that the Bank of

England may start cutting interest rates as soon as June. However,

the upturn in the pace of economic growth signalled by the PMI, and

the upsurge in firms’ cost pressures, suggest that business

conditions are more consistent with rate hikes rather than rate

cuts. Both the composite flash PMI output index and input cost

index are above their long run averages and rising.

Access the press release

here.

Chris Williamson, Chief Business Economist, S&P

Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers’ Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.