(Kitco News) – The recent sharp rise in the M2 money supply means the Federal Reserve won’t be able to deliver on expected interest rate cuts this year, according to Bert Dohmen of Dohmen Capital Research.

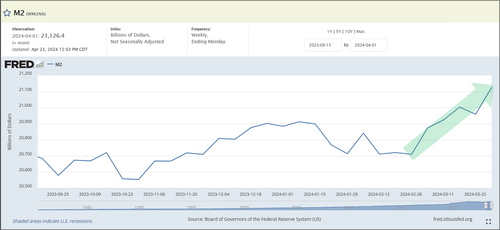

“We have been referring to the growth of M2 (money supply) as one of the factors that shows that the Fed has NOT been fighting inflation,” Dohmen wrote in a recent report. “Below we show the updated weekly chart of Money Supply M2, which continues to soar. It is the ‘not seasonally adjusted’ and therefore, does not include the usual fudge factor of ‘seasonal adjustment’ (chart via St. Louis Fed, with our annotations).”

Dohmen said that understanding the difference between the Fed’s seasonally adjusted and not seasonally adjusted data during the 1978-1980 period of runaway inflation “saved and made our members a fortune.”

After the banks’ prime rate hit a high of 20% in March of 1980, rates dropped significantly. “The bond bulls jumped in and bought T-bonds,” he said. “Big mistake!”

“In the summer of 1980, the ‘seasonally adjusted’ money supply growth was still down significantly from its peak earlier that year,” he said. “But we noticed that the ‘not seasonally adjusted’ M2 started rising rapidly although the Fed vowed it was still fighting inflation.”

Dohmen said this was actually not the case, and it led him to correctly predict that the prime rate would reach a higher peak by the end of the year. “Lo and behold, on December 10, 1980, the prime rate made a new high of 21.5%,” he said.

“This current cycle, the prime rate may not go quite that high because the economic statistics are so intentionally false,” Dohmen wrote. “Look at the beautiful upside chart breakout of M2 on the chart above, soaring to a new high above the previous January 2024 high. If that were a stock, it would be a ‘buy.’”

Dohmen said the Fed is “stuck between a rock and hard place” as they are forced to finance record Treasury deficits while also continuing to fight stubbornly high inflation, and he believes “the massive amount of Treasury debt to be sold each week in the markets, to finance the huge deficits, will eventually cause ‘indigestion,’ i.e. a buyer strike.”

“Is it possible that perhaps they want to blame the weakness of the bond market, i.e. rising rates, on inflation?” he asked. “The US Treasury cannot allow the market to start worrying about insufficient market demand for the Treasury debt. Therefore, it is better to blame the weak bond market on inflation pressures.”

To support his case, Dohmen shared a chart of the longer-term monthly performance of the iShares Barclays 20+ Year Treasury Bond ETF (TLT). “It plunged 53% into late 2023, rallied, and now should go back to the 2023 low (red horizontal line),” he wrote.

“The Fed is being forced to step on the accelerator to enable the financing of the record deficits at the US Treasury,” he concluded. “They know that is inflationary, but they have no alternative.”

Because of this, Dohmen said that all the discussions about how many times the Fed may lower interest rates this year are meaningless. “They know that they most probably will not be able to cut ruts at all, which will only add more fuel to the markets, especially in the top sectors and stocks that have been propelling this recent rise,” he said.

Since forming a double top pattern around the $171 level at the outset of the pandemic in spring and summer of 2020, TLT has seen a steady decline since, last trading at $90.15 at the time of writing.

In its April ‘Fiscal Monitor’ update, the IMF warned that the U.S. Treasury’s plans to issue more debt, even as it continues its quantitative tightening, has likely fueled the recent rise in bond market volatility, according to a recent Reuters report.

Barclays pointed out that overseas private investors now hold more of the United States’ $25 trillion in outstanding debt than overseas governments.

“This has implications for how Treasury supply will be received by markets, not just in terms of the term premium that is demanded to own Treasuries, but also the volatility of the rates markets,” Barclays analysts said.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.